When interest rates change, it can have a significant impact on home buyers. Here’s a general summary of how changing interest rates can affect them:

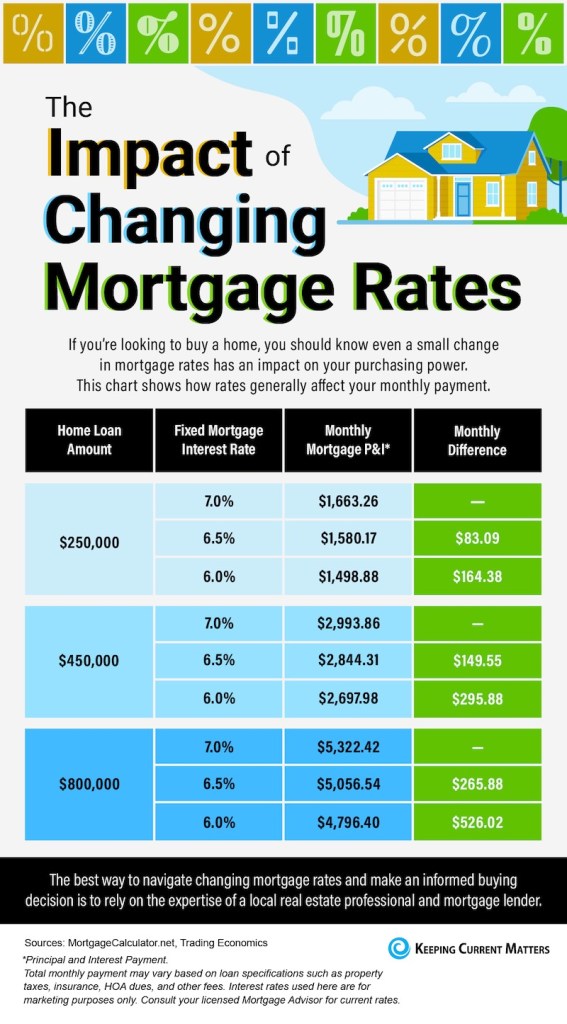

- Affordability: Higher interest rates increase the cost of borrowing, which means monthly mortgage payments can become more expensive. This can reduce the purchasing power of home buyers, as they may qualify for smaller loan amounts or have to adjust their budget.

- Housing affordability: Rising interest rates can lead to decreased affordability in the housing market. As borrowing costs increase, some potential buyers may be priced out of the market or have to settle for a lower-priced home than originally anticipated.

- Mortgage payments: Higher interest rates can increase the monthly mortgage payments for home buyers. This can impact their overall budget and potentially limit their ability to save or invest in other areas.

- Mortgage qualification: Increasing interest rates can make it more challenging for some buyers to qualify for a mortgage. Lenders typically assess a borrower’s ability to make monthly payments based on their income, debt-to-income ratio, and credit score. Higher rates may require a larger income or better credit score to meet the lender’s criteria.

- Refinancing: Changing interest rates can also impact existing homeowners who consider refinancing their mortgages. If rates increase, it may make refinancing less attractive, as the new interest rate may not be significantly lower than its current rate.

- Market activity: Fluctuations in interest rates can influence overall housing market activity. When rates are low, it generally stimulates demand as buyers find it more affordable to finance a home. Conversely, higher rates can cool down the market, leading to reduced buyer demand and potentially impacting home prices.

It’s important to note that the impact of changing interest rates can vary depending on various factors, including the local housing market conditions, individual financial situations, and the specific terms of the mortgage. Consulting with a mortgage professional or financial advisor can provide personalized insights and guidance for home buyers in navigating changing interest rates.

*Info provided by Keeping Current Matters

Leave a comment