In the current housing market, prospective homebuyers and sellers are understandably concerned about mortgage rates. Whether you’re a first-time buyer or looking to upgrade to a more suitable home, you likely have two burning questions on your mind: Why are mortgage rates so high, and when can we expect them to go back down? Let’s dive into the context behind these queries and shed some light on the subject.

- Why Are Mortgage Rates So High?

The primary driver of 30-year fixed-rate mortgages is the supply and demand for mortgage-backed securities (MBS). Mortgage-backed securities are investment products similar to bonds, comprising bundles of home loans and other real estate debt purchased from banks that issued them. When investors buy MBS, they essentially lend money to homebuyers.

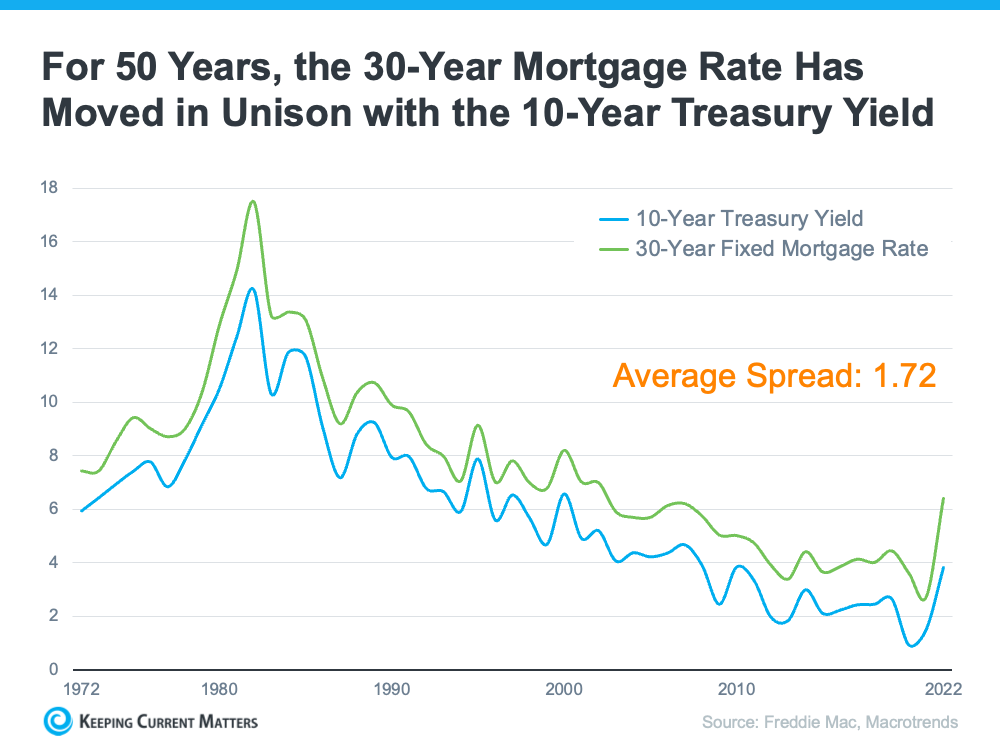

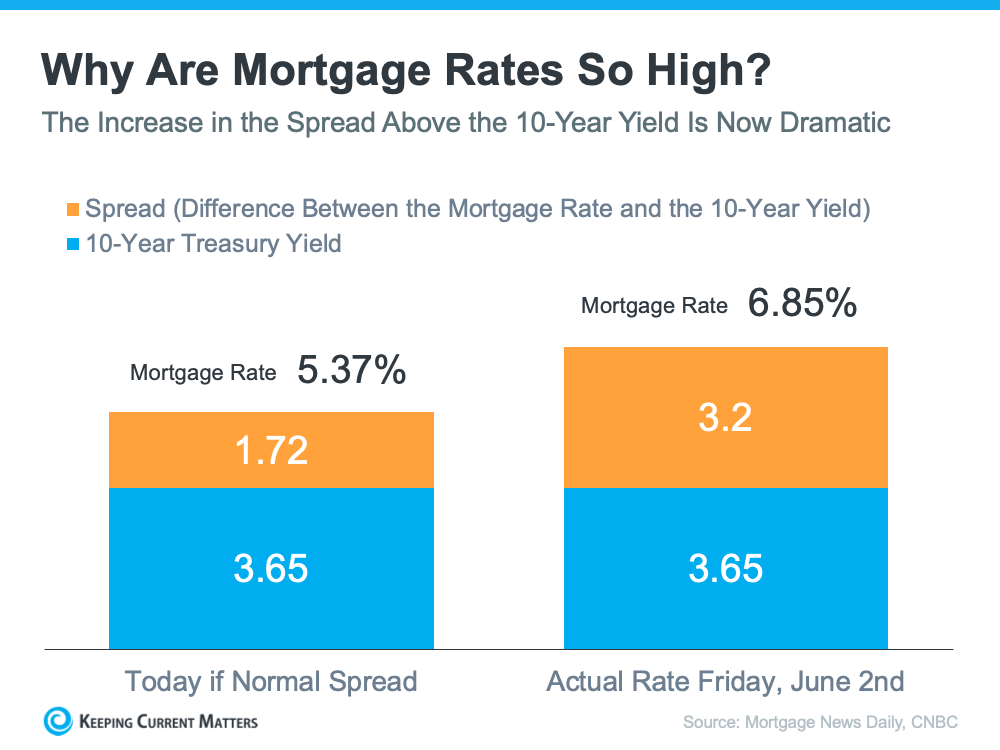

The demand for MBS plays a crucial role in determining the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two has been 1.72%. However, as of last Friday morning, mortgage rates stood at 6.85%, indicating a spread of 3.2%. This deviation from the norm is significant, as George Ratiu, Chief Economist at Keeping Current Matters (KCM), points out.

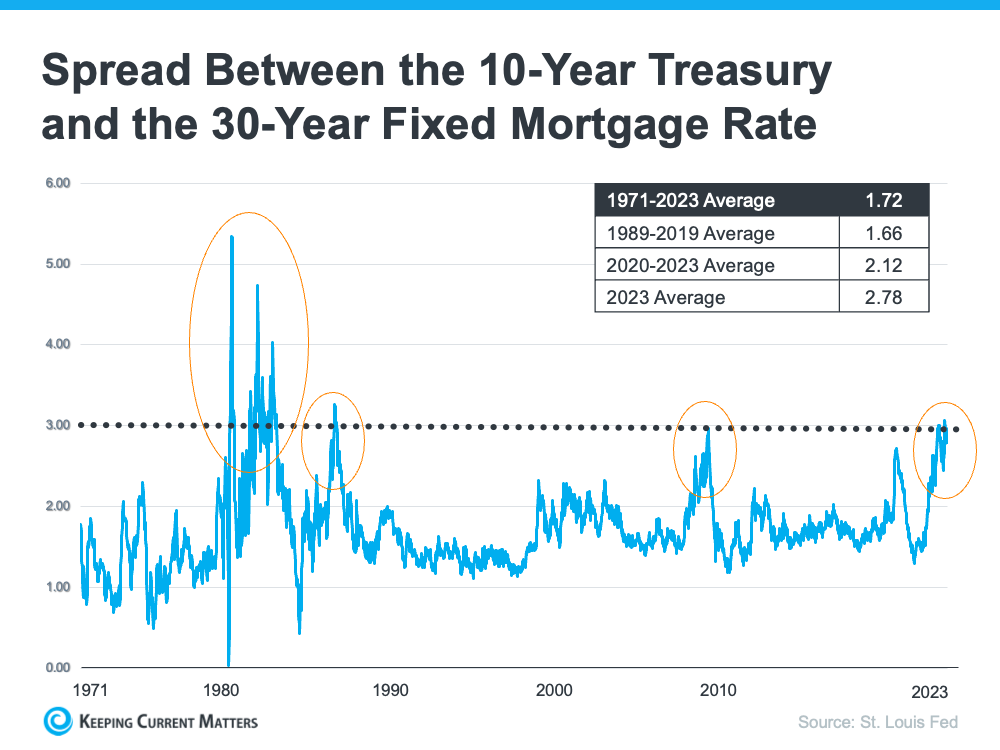

Typically, the spread surpasses or approaches 300 basis points only during periods of high inflation or economic volatility, such as those witnessed in the early 1980s or the Great Financial Crisis of 2008-09. The graph below illustrates these instances where the spread exceeded 300 basis points:

The graph also demonstrates how the spread has gradually declined after each peak, indicating the potential for improvement in mortgage rates today.

So, what’s causing the larger spread and the high mortgage rates we’re experiencing? Several factors come into play. The demand for MBS is heavily influenced by the risks associated with investing in them. Presently, these risks stem from broader market conditions like inflation and concerns about a potential recession. The Federal Reserve’s interest rate hikes to counter inflation, negative narratives about home prices in the media, and other elements contribute to the overall risk perception. When there’s less risk, demand for MBS is higher, resulting in lower mortgage rates. Conversely, when MBS carries more risk, demand diminishes, leading to higher mortgage rates. Currently, low demand for MBS is driving high mortgage rates.

- When Will Rates Go Back Down?

Addressing the question of when mortgage rates will decrease, Odeta Kushi, Deputy Chief Economist at First American, provides some insight in a recent blog post. Kushi suggests that if the Federal Reserve eases off on its monetary tightening measures and offers investors more certainty, it’s reasonable to expect the spread, and consequently mortgage rates, to retreat in the second half of the year. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as certain risks are likely to persist.

In summary, as investor fears subside, the spread will contract, leading to more moderate mortgage rates as the year progresses. Nevertheless, when it comes to predicting mortgage rates, certainty is elusive, and no one can accurately forecast what will happen.

In conclusion, understanding the reasons behind today’s high mortgage rates and their potential future trajectory can provide valuable insights for homebuyers and sellers. By keeping a close eye on market conditions, economic factors, and Federal Reserve policies, you can make informed decisions regarding your housing plans.

*Info provided by Keeping Current Matters

Leave a comment