If you’ve been following the news lately, you might be feeling uncertain about the state of home prices and apprehensive about what the future holds. However, it’s important not to let sensational headlines paint an unnecessarily negative picture. By taking a closer look at the data and considering the year-over-year view, we can gain a clearer understanding of the housing market’s trajectory and dispel any fears. While there was a drop in home prices compared to an exceptional peak, a monthly analysis tells a different, more positive story. Let’s explore the national data and recent trends that suggest a shift towards rising prices.

Understanding the Monthly View:

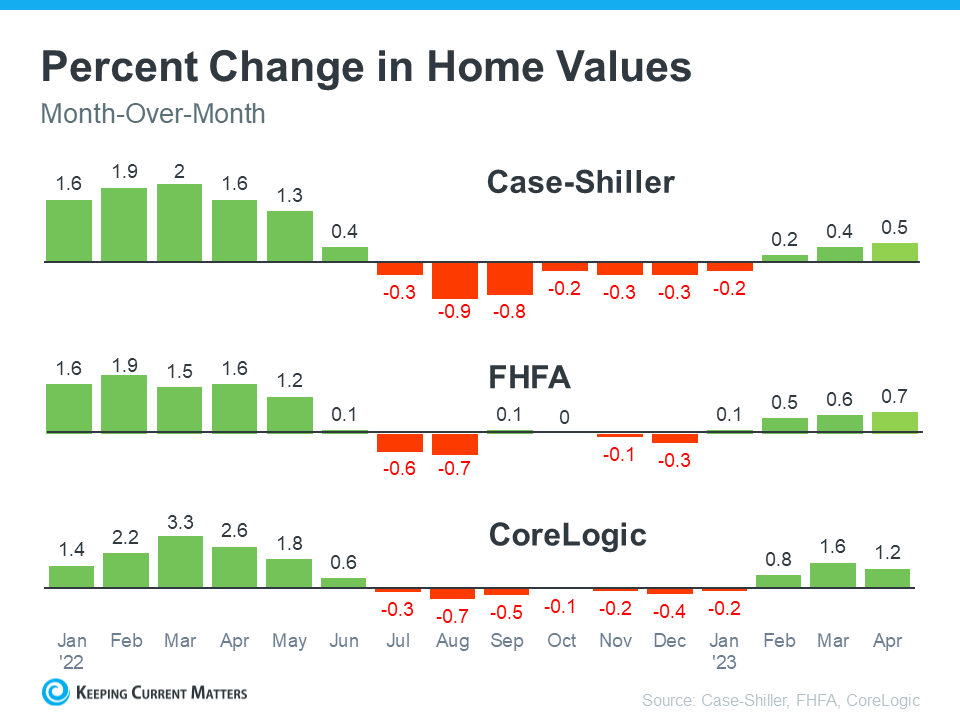

To avoid unfair comparisons to an extraordinary peak, we need to focus on monthly data, which offers a more accurate representation of the market’s current state. By examining recent monthly reports from reputable sources, we can see that the worst home price declines are already behind us, and prices are appreciating nationally.

In the first half of 2022, home prices experienced a significant upward surge, but starting in July, prices began to decline. However, this downward trend stabilized by around August or September, and the most recent data for early 2023 indicates that prices are once again on the rise.

Encouraging Signs for the Housing Market:

All three reports consistently show that home prices have been increasing for three or more consecutive months. This is an encouraging sign for the housing market and suggests a positive national shift is underway. According to Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, the data reinforces the notion that the decline in home prices that began in June 2022 has likely come to an end.

Factors Influencing Price Stability:

Experts believe that the housing market has not experienced the drastic crash that some anticipated due to a shortage of available homes relative to the number of interested buyers. Even with current mortgage rates, the demand for homes continues to outpace supply, which puts upward pressure on prices.

Mark Fleming, Chief Economist at First American, explains that historically, higher rates may slow price growth but rarely cause prices to collapse entirely. This is especially true today, given the persistent demand for homes. Doug Duncan, Senior VP, and Chief Economist at Fannie Mae, also highlights the robust growth in home prices, exceeding expectations and driven by strong demographic-related demand.

Implications for Buyers and Sellers:

Buyers who have been hesitant to enter the market due to concerns about declining home values can find some relief in the knowledge that prices have rebounded. Moreover, owning a home generally proves to be a valuable long-term investment.

On the other hand, sellers who have been waiting for a stable market to sell their homes can consider teaming up with a real estate agent to list their properties. The latest data suggests that conditions are shifting in favor of sellers, providing an opportune time to make a move.

Conclusion:

If you’ve been holding off on your housing plans out of worry about plummeting home prices, it’s time to reassess. The latest data reveals that the worst is already behind us, and home prices are appreciating nationally. To stay informed about the situation in your local area, it’s advisable to partner with a knowledgeable real estate agent who can provide insights tailored to your specific market.

Ultimately, the outlook for home prices is positive, indicating a market that is stabilizing and moving toward growth. Don’t let misleading headlines sway your decisions—instead, rely on accurate data and expert opinions to make informed choices in your real estate journey.

*Info provided by Keeping Current Matters

Leave a comment