Have you ever wondered how inflation impacts the housing market? Surprisingly, these seemingly unrelated aspects of the economy are intricately connected. Any changes in one inevitably ripple through the other. In this blog post, we’ll provide you with a high-level overview of the fascinating relationship between inflation and the housing market.

The Relationship Between Housing Inflation and Overall Inflation

To understand the connection between inflation and housing, let’s start by examining shelter inflation. Shelter inflation is a measure of price growth specific to housing. It is derived from a survey conducted by the Bureau of Labor Statistics (BLS), which asks both renters and homeowners about their housing costs.

Much like how overall inflation gauges the cost of everyday items, shelter inflation measures the cost of housing. Recent data from the survey shows that for four consecutive months, shelter inflation has been on a decline. This decline is significant because shelter inflation contributes to approximately one-third of overall inflation, as measured by the Consumer Price Index (CPI). Thus, any shifts in shelter inflation are bound to have noticeable impacts on overall inflation trends. This current dip in shelter inflation might just be a signal that overall inflation could decrease in the coming months.

This moderation in inflation would be welcomed by the Federal Reserve (the Fed), which has been actively working to control inflation since early 2022. Although they’ve made progress (inflation peaked at 8.9% in the middle of the last year), they are still striving to reach their 2% target (the latest report indicates 3.3% inflation).

Inflation and the Federal Funds Rate

So, how has the Fed been combating inflation? They’ve been increasing the Federal Funds Rate, a key interest rate that influences the cost of interbank borrowing. Whenever inflation begins to climb, the Fed responds by raising the Federal Funds Rate to prevent the economy from overheating.

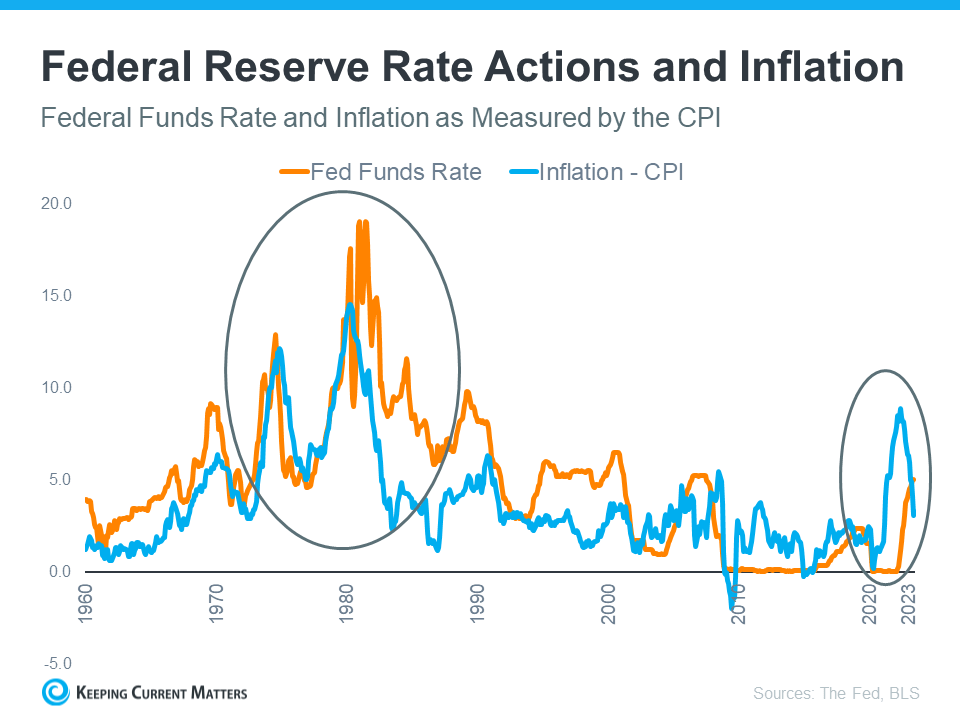

The graph below illustrates the relationship between inflation (shown in the blue line) and the Federal Funds Rate (shown in the orange line). Each time inflation starts to rise, the Fed raises the Federal Funds Rate to bring it closer to its 2% target.

The circled portion of the graph highlights the most recent spike in inflation, the Fed’s response in raising the Federal Funds Rate, and the subsequent moderation in inflation as a result of these actions. As inflation inches closer to the Fed’s desired 2%, they may find it unnecessary to further increase the Federal Funds Rate.

A Brighter Future for Mortgage Rates?

Now, let’s consider what all of this means for you, particularly in terms of mortgage rates. While the actions taken by the Fed don’t directly determine mortgage rates, they do exert an influence. Mortgage Professional America (MPA) explains this relationship by stating that “mortgage rates and inflation are connected, however indirectly. When inflation rises, mortgage rates rise to keep up with the value of the US dollar. When inflation drops, mortgage rates follow suit.”

Although no one can precisely predict the future of mortgage rates, it is encouraging to observe signs of moderating inflation in the economy. This trend could potentially lead to more stable or even lower mortgage rates in the foreseeable future.

Bottom Line

Whether you’re contemplating buying, selling, or simply staying informed about the housing market, it’s advisable to connect with a local real estate expert who can provide guidance and insights. Understanding the intricate interplay between inflation and the housing market can be a valuable tool for navigating these complex economic waters. So, make sure to stay informed and make the most informed decisions for your real estate goals.

*Info provided by Keeping Current Matters

Leave a comment